Monday, June 30, 2008

European Central Bank raises rates ahead of Fed

Citigroup Inc., Merrill Lynch & Co. and Lehman Brothers Holdings Inc. were among the firms that declined. The purchasing association's monthly index of regional manufacturing fell to 39, its fourth straight month below 50. A reading lower than 50 means the number of manufacturers that said business deteriorated was greater than the number saying it improved.

Treasuries earlier fell, extending the biggest quarterly decline since 2004, as inflation in the euro region rose to the highest in 16 years and oil advanced above $143 a barrel.

The retreat pushed 10-year yields up from a three-week low after a European Union report showed the rate of euro-region inflation climbed to 4 percent, bolstering the case for the European Central Bank to raise rates. Why are they ahead of us?

Crude oil for August delivery rose as much as $3.46, or 2.5 percent, to $143.67 a barrel in electronic trading on the New York Mercantile Exchange. It reached $142.99 a barrel on June 27 after the Fed left interest rates unchanged at 2 percent. The market continues to struggle with what to do with the rise in oil.

Friday, June 27, 2008

How do you spell Recession?

Traders pushed two-year note yields to the lowest level in almost three weeks after U.S. consumer confidence fell to a 28- year low. Demand for the safety of government debt also rose as financial news network CNBC reported Merrill Lynch & Co. may post a second-quarter loss and write down the value of mortgage- related assets by as much as $5 billion, citing unidentified people.

Treasuries are still headed for their biggest quarterly loss in four years because of speculation in past weeks that rising energy prices would prompt the Fed to boost interest rates.

With the economy in a slump, and with prices rising rapidly, the Fed has found itself in a dilemma. Short-term rates already are low, and if the central bank cuts them more to stimulate economic growth, then prices could rise even faster and get out of control. If the Fed raises short-term rates, the result could be a recession (or a deeper recession, if the economy already is in one) and a delayed recovery. The economy cannot handle interest-rate increases. On the other hand, inflation pressure is going up. They're stuck between inflation and recession.

Thursday, June 26, 2008

june 27 SP 500 gap up to 1295 1300 then fall

Wednesday, June 25, 2008

Tuesday, June 24, 2008

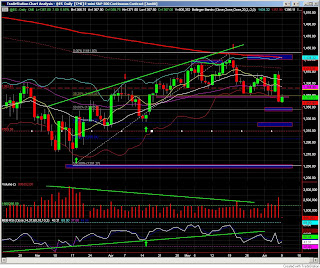

June 24 SP 500 Emini Daily Chart

Fed meeting coming up on wed.

Treasuries rose as reports showed consumer confidence fell to a 16-year low and housing prices dropped more than forecast, reducing the likelihood that the Federal Reserve will boost interest rates.

Traders see a 90% chance policy makers will leave the target rate for overnight lending between banks at 2 percent when their two-day policy meeting ends tomorrow, according to futures contracts on the Chicago Board of Trade. The odds policy makers will raise the key rate by at least a quarter-percentage point this year are 98 percent.

U.S. securities began to tumble in March as traders forecast the Fed will push borrowing costs higher later in 2008 to quell quickening inflation.

In an indication companies are passing higher commodity prices onto consumers, Dow Chemical Co. said it will raise prices on its products by as much as an additional 25 percent in July because of ``relentless'' gains in the cost of energy. How do you think it effects commuters?

The difference between yields on 10-year Treasury Inflation Protected Securities, or TIPS, and conventional notes was 2.46 percentage points, compared with 2.51 a week ago. The figure, which reflects the inflation rate that traders expect for the next decade, has increased from 2.20 percentage points in January.

Investors bid for 2.28 times the amount of government debt on offer at the Treasury's previous two-year sale on May 28, versus an average of 2.60 times for the past 10 sales.

Monday, June 23, 2008

SP 500 daily June 23 support being challenged

S&P 500 and the Economy. Financials wounded.

The Big three car makers, GM, Ford and Chrysler, have huge inventories of SUV's, Trucks and other gas guzzlers and have no inventory of economy cars. We could see one of these Bankrupt this year as all three have been downgraded by S&P to"credit watch negative."

Combine this with our Airlines declaring that the they will post losses of 18 Billion......this year.

Sunday, June 22, 2008

June 22 SP 500 gap up

Friday, June 20, 2008

S&P 500 moving down, will test lows.

Treasuries gained, poised for a weekly increase, as traders pared bets the Federal Reserve will raise interest rates this year amid signs stress is returning to the financial sector. The cost of protecting corporate bonds from default rose to the highest in two months. Lehman Brothers Holdings Inc. forecast that Fannie Mae and Freddie Mac, the two largest sources of U.S. home loans, may lose money in the second quarter as the housing market deteriorates, and Merrill Lynch & Co. said regional bank stocks are in ``capitulation mode.'' Oil rose after the New York Times reported an Israeli military exercise last month appeared to be a rehearsal for an attack on Iran's nuclear facilities.

Traders see a 90 percent chance the Fed will leave its 2 percent target rate for overnight lending between banks unchanged at its meeting on June 25, up from 78 percent a week ago, futures on the Chicago Board of Trade show. The rest of the bets are for a quarter-percentage point increase.

U.S. stocks fell, extending a third straight weekly drop for the Standard & Poor's 500 Index, which declined 1.3 percent, after analysts said worsening credit losses will reduce earnings at financial companies. Europe's Dow Jones Stoxx 50 Index lost 1.2 percent.

Thursday, June 19, 2008

SP 500 after close June 19

Tuesday, June 17, 2008

SP 500 Weekly still headed south June 17 watch out for Stagflation.

No help for the country, Senate is on wrong boat.

This is ridiculous. Crude oil for July delivery fell 60 cents to settle at $134.01 a barrel on the New York Mercantile Exchange at 3:04 p.m., after touching a record $139.89 yesterday. Everyone is saying it is going down after reaching these highs but guess what? This is the break through price I warned about last year, from here $150 is just a few days away.

Monday, June 16, 2008

Inflation Kills Bonds

The combination of rising commodity prices, Federal Reserve Chairman Ben S. Bernanke's renewed focus on inflation and his success in reviving capital markets after the collapse of subprime mortgages has turned Treasuries into a quagmire. Investors who bought notes due February 2018 on March 17, just after the Fed helped arrange the bailout of Bear Stearns Cos., have lost 6.2 percent.

Inflation is also eliminating the rewards of owning U.S. stocks. Standard & Poor's 500 Index shares yield 0.2 percentage point more in profits than the interest on 10-year notes, the smallest advantage since 2004. Yields touched the highest since December as oil prices climbed to a record $139.12 a barrel this month, and are up from 3.28 percent on March 17. Unless you subscribe to the notion that the economy will slow and help relieve some of the inflation pressures, bond yields look like they need to move higher and fair value is off in the distance.

This means Interest rates will go up. Mortgage rates will go up. Lending will probably tighten and relief for home sales will be disappearing again.

Thursday, June 12, 2008

Secret to Futures Trading

Your subjective % vested in your trade is too high. Make it a system or be a victim. Decrease subjectivity in your criteria for a trade. 10% subjectivity is what I look for to make a high probablitily trade. I only use instincts for managing profitability, not for managing risk..Risk is rules only. Hope that helps.

Monday, June 9, 2008

Economic News

Rates on 30-year mortgages edged up last week to the highest level since March as investors worried about inflation threats. Freddie Mac reported Thursday that 30-year fixed-rate mortgages averaged 6.09 percent, compared with 6.08 percent the previous week. It was the highest mark for 30-year mortgages in 12 weeks since averaging 6.13 percent the week of March 16.

U.S. Payrolls -49K, Unemployment Rate Climbs to 5.5%, after payrolls fell 28,000 in April and 88,000 in March. The unemployment rate, which is calculated using a separate survey of households, jumped 0.5 percentage point to 5.5%, its highest level since October 2004.

Real-Estate Woes of Banks Mount: Lenders Dumping Bad Loans at Discount; Regulators See Losses Continuing. Federal regulators warned Thursday that banking-industry turmoil would continue as financial institutions come to terms with piles of bad loans they made to finance the construction of homes and condominiums, which in turn could lead to billions of dollars in fresh losses.

Household Net Worth Fell 2.9% in 1Q08, the Most in 5 Years. According to our Federal Reserve, stock-market losses and falling home values in the first three months of this year led to the largest quarterly drop in the net wealth of American households since 2002.

Standard & Poor's said the number of entities at risk of having their ratings cut hit a new record of in May as a "material slowdown" in housing and consumer activity amid still-tightening lending conditions continues to deteriorate credit quality.

Mortgage applications in the U.S. last week dropped to the lowest level in six years, reflecting less refinancing as interest rates jumped.

ReconTrust, a unit of Countrywide, filed a notice of default on a $4.8 million Countrywide loan backed by Ed McMahon's home, who is $644,000 in arrears.

Goldman, the most profitable securities dealer, and Lehman, the top-ranked bond research firm in Institutional Investor's annual survey for eight years, bet the economy is too weak to spark runaway inflation and an increase in the Federal Reserve's target interest-rate for overnight loans between banks. Though futures traded on the Chicago Board of Trade show a 67 percent chance policy makers will boost the fed funds rate by year-end, they haven't started to raise borrowing costs with growth below an annualized 2 percent rate since 1980. The capital markets are underestimating how sluggish the economy is going to be. Any tightening priced into the fed funds futures market is premature at this stage of the game.

Fed Chairman Ben S. Bernanke said in an address June 4 at Harvard University in Cambridge, Massachusetts, that data showing the public expects price increases to accelerate is a ``significant concern'' for the central bank.

The case for an increase became weaker on June 6, as the Labor Department said that the unemployment rate surged to 5.5 percent in May from 5 percent in April. The gain was the biggest since February 1986. The economy is not performing at a rate that even remotely suggests they should raise interest rates along the lines that the markets are implying.

The Only way we will get oil under control is to raise Intrest Rates. Protect the dollar.