Tuesday, April 29, 2008

Fed cut, Europe to head into recession.

The credit crisis is far from being over. The market's telling you the Fed's going to 2 percent tomorrow and will say in the statement they'll be in a sit-and-watch mode. The weak-economy type talk is pro-bonds. Today's home-price report is a reminder that the economy remains weak and housing has been a disaster, and we probably haven't seen a bottom in it yet.

Other reports this week will show the economy hardly grew in the first quarter and employers cut jobs in April for a fourth month, surveys forecast. Frankfurt-based Deutsche Bank, Germany's biggest bank, reported a quarterly loss after writing down the value of loans for leveraged buyouts and asset-backed securities by 2.7 billion euros ($4.2 billion). Europe is next, England will probably be kicking the recession off over there.

Futures contracts on the Chicago Board of Trade show an 84 percent chance the Fed will trim its target for overnight lending between banks by a quarter-percentage point to 2 percent tomorrow, compared with a 78 percent likelihood yesterday. The balance of the bets is for no change in borrowing costs. Traders also see a slimmer chance the Fed will start lifting rates later this year. The likelihood of an increase to 2.5 percent at Fed meetings in September, October and December declined today, futures show.

Monday, April 28, 2008

What do you mean 6.25%?

Let's firsts take a look at the fed rate. The general media has been singing the praises of the valiant attempts of the fed to reign in the subprime debacle and help out the average Jim with the ever increasing monthly payments on the adjustable mortgage rates. What is unreasonable to expect a lower rate for these victims of the tricky loans that they have committed to when the fed has lowered their rate 3% points.......First of all, the fed funds rate and the discount window are not for individuals to access funds. Historically, the opposite

The last time the Fed was in a lengthy rate cutting cycle was back in 2001 from January 3, 2001 to December 11, 2001. In the span of 11 months, they cut the Fed Funds rate 11 times with eight of those cuts by 50bp. This resulted in a total of 475bp or 4.75% in short-term interest rate cuts taking the Fed Funds Rate from 6.00% down to 1.75%. Now most uninformed people would naturally think because the Fed cut rates by so much during this time that mortgage rates would follow suit and trend lower as well. Not so. Mortgage rates actually moved higher during this time of significant rate cuts because inflation, the arch enemy of bonds, gradually rose.

Now let's take a look at what happened with the Fed's most recent cutting cycle, the first since 2001. On September 18, 2007 the Fed cut the Fed Funds Rate by 50bp.

The mortgage bond market briefly enjoyed a "knee-jerk" reaction to the Fed move by closing higher that day, but lost 140bp over the following two sessions. Then on October 31, 2007 the Fed lowered the Fed Funds rate by 25bp. The mortgage bond market responded by losing 78bp over the following five trading days. On December 11, 2007 the Fed once again lowered rates by 25bp and the mortgage bond market lost 88bp in the next three days.

So far this year, the Fed delivered a surprise 75bp rate cut on January 22, 2008 and mortgage bonds lost a whopping 144bp in just 2 days. Eight days later and as widely expected, the Fed cut rates by 50bp. Within 13 days from that 50bp cut, mortgage bonds lost 269bp. On March 18, 2008 the Fed cut by 75bp and mortgage bonds lost 113bp in 6 days and 214bp in 22 days.

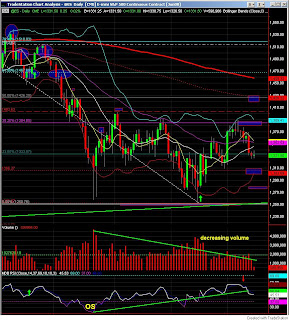

Longer term SP 500

1. 1424 target and then news for a correction

2. still consolidate in this range then a move up to a higher high maybe a 1.61 projection to 1492

I think the 1458 retrace is more likely, at which time this is the reaction high from 1252 and then a full capitulation of the bull and a move to 1108.

Also I can see this consolidating and then slight moves up until the elections. Next Feb would then kick off our next bear session.....

We shall see.

Wednesday, April 23, 2008

Rice famine on the horizon.

Rice, the worlds staple, is now going through a hoarding phase in the market. The fear of a short supply in the world market has countries as well as individuals scrambling.

If Thai land curbs its sales of rice we could see price double again. It is unfortunate that this hoarding actually does cause the market to react with high prices which knock out some countries like Bangladesh from the purchasing market. This is what will turn the "starvation curve" around and put more at risk-below poverty line families closer to starvation. This is the same pattern seen in previous rice famines........

Tuesday, April 22, 2008

ES Daily april 22 after hours

Looks like we have a channel.

Watch out for Rice prices

Watch out for Wheat prices

Oil to break $120

Banks and Financials need a higher market to keep the creditors at bay and to keep the expected 250,000 homes that haven't recieved their Notice of Defaults off their books.

Although we are seeing a slight uptick in home purchases compared to last month, the numbers of foreclosures are up 57% over last year and expecting bigger numbers in the months ahead.

Dollar also looks like it might get a bit of a break as the Bank of England is stepping in to help out with the Financial companies that have big losses in subprime. Holland, Belgium and England are also entering their first rounds of Foreclosures as overpriced properties have hit their highs and starting to plummet.

China's economy is the strongest it has ever been expecting the largest GDP % move ever......

Friday, April 18, 2008

Thursday, April 17, 2008

Google lights the fire SP 500 to 1410

This is the dynamic area where Market Makers and Money Makers are taking advantage of the short term direction pushing the market so Investors will get back in. How long will this last, I don't know, but once the sentiment changes a little about stocks, the Market Makers will strip the profit out.

I am looking for an increase in volume to add to this volatitlity.

Big gap up on the open tomorrow.

Trade what you see.

Fear is resceding is the bull back?

Fear is receding. People are looking at where fed funds is going to be, maybe settling in at 2 percent, and saying do we really want to own two-year notes at 1.5 percent if things are settling, if there's less risk to the system. Traders added to bets the Fed will cut its target rate by just a quarter-point to 2 percent on April 30. Futures on the Chicago Board of Trade show a 76 percent chance of that size reduction, up from 58 percent a week ago. The rest of the bets are on a half-point cut. Traders now see a better-than-even chance the rate will stay at 2 percent through next quarter.

Swap spreads widened amid the increase in Libor rates, which typically signals a decline in risk appetite. The spread between Treasury yields and the rate on a two-year interest-rate swap, used to hedge against interest-rate swings, reached as wide as 101.88 basis points, from 96.25 yesterday. Rising swap rates can lead investors who are receiving fixed payments to sell Treasuries to hedge the risk that rates will rise.

Wednesday, April 16, 2008

Tuesday, April 15, 2008

treasuries fall inflation increases oil going up

Crude oil climbed above $113 a barrel, the highest since futures began trading in 1983, on supply disruptions in Nigeria and Mexico.

Inflation expectations increased a fourth straight day, Treasury yields indicate. Given what inflation is doing, it makes it more difficult for the Fed'' to lower rates or increase cash in the banking system.

SP 500 daily April 15

Friday, April 11, 2008

Grains and Food around the world

China and Vietnam have implemented food export controls

Rice prices have soared by up to 70% in world markets

Philippines must now import rice to feed its growing population

The Wall Street Journal recently reported the worst case of food inflation in the US in 17 years

There have been food riots in Mexico City, food strikes in Italy, and violent protests in many areas of Africa, South America, and Haiti

UN representatives are encouraging the EU to relax their opposition to genetically modified foods

Millions of people in the emerging middle class of China and other Asian nations are demanding more meat in their diets, as they associate meat-eating with prosperity

Grains are experiencing record demand for use as animal feedstock

In the United States this year, nearly a third of the corn output will be used to make an estimated 9.3 billion gallons of ethanol (a lower priced oil alternative)

GE leads the market down fed had 6 rate cuts

U.S. stocks fell after GE, based in Fairfield, Connecticut, said first-quarter earnings slumped 12 percent because of an inability to sell some assets and higher-than-forecast losses at its finance businesses. The Standard & Poor's 500 index fell 1 percent, the most in two weeks.

Traders increased bets the Fed will add to its six rate cuts since September to bolster economic growth, futures on the Chicago Board of Trade show. Traders see a 52 percent chance the Fed will lower its rate for overnight lending between banks by a half-point to 1.75 percent on April 30. The likelihood of a cut that big hasn't been above 50 percent since March 31. Futures also indicate a 21 percent chance the Fed will lower the rate to 1.5 percent by June.

Thursday, April 10, 2008

SP 500 daily How many more days of consolidation

Wednesday, April 9, 2008

what is another 6-6.5 billion

Unlike earlier writedowns at Merrill (NYSE: mer) and other Wall Street investment banks, the latest round of write downs are not solely tied to subprime loans, but instead are linked to commercial real-estate debt exposure and other types of loans, these people said.

Monday, April 7, 2008

Bond prices down

Bernanke told the Joint Economic Committee of Congress last week that the Fed's actions ``will help to promote growth over time and to mitigate the risks to economic activity.''

The bond market is looking much like it did in December, when yields rose as much as 0.27 percentage point to 3.91 percent on average. The increase followed the Fed's Dec. 11 decision to cut its target for overnight loans between banks to 4.25 percent.

The slump in Treasuries since the bailout of Bear Stearns was interrupted on April 4 after the Labor Department said company payrolls contracted by the most in five years during March. At the same time, wages grew at the slowest pace since 2005, bolstering speculation that inflation will decline as Bernanke said it would.The April 4 rally wasn't enough to keep Treasuries from declining last week. Two-year note yields climbed 17 basis points to 1.81 percent, and are up from 1.24 percent on March 17, the lowest since July 2003.

Sunday, April 6, 2008

last rally to 1431 or a fall SP 500

We shall see,

always trade with stops.

Friday, April 4, 2008

SP 500 daily April 4 targets hit

63000 jobs cut fed fund rates cut 75 basis points too

Exacerbating the situation, not only did February come in weak, but the prior two months were also revised down. The initial January estimate of a 17,000 drop was revised down 5,000, while December was revised down 41,000 from the previous estimate of an 82,000 increase. For Janu ary and December combined, the net revision was down 46,000, indicative of a very clear downward path. February also marked a full year of payroll survey weakness in the goods-producing sectors, with both construction and manufacturing entering its 21st consecutive monthly decline.

Several key factors are thought to have influenced the February NFP report.

They include:

* Government payroll expected to add just 15K to March payrolls

* Private service providing payrolls expected to edge just -5K lower, from -12K in February and a 100K average in Q4

Unemployment rate expected to rebound to 4.9% following December’s 5% high

For week ending March 29, 2008, the Department of Labor reported that the advance figure for seasonally adjusted initial claims was 407,000, an increase of 38,000 from the previous week’s revised figure of 369,000. They also reported a four-week moving average of 374,500, a n increase of 15,750 from the previous week’s revised average of 358,750.

The back-to-back payroll declines that started 2008 is disturbing for the economy as the weaker growth has become more broad-based and trend like. Payrolls have shown weaker growth for four months from a 140K gain in October. Unemployment is rising from the March low of 4.4% but fell to 4.8% in February after reaching 5% in December. Employment trends lag the economy as final demand—in excess of labor productivity—feeds in to labor demand. Earnings growth is fading and stands at 3.7% compared to the 4.3% yoy high of late 2006. The loosening labor market is being watched for signs of unraveling—which many analysts will say has arrived in the payroll data.

What is the non-farm payroll report?

Of all the world monthly economic reports, the monthly US NFP report is the most highly anticipated and has the most dramatic impact on the currency market.

The report, which is released on the first Friday of each month and states the previous month’s numbers, provides detailed industry data on employment, hours and earnings of workers on nonfarm payrolls. These numbers are the best way to gauge the current state of the US market as well as the direction that the economy is heading.

What’s more, the employment numbers provided by the report are used by the Fed to shape their interest rate policies. The health of the US economy and interest rates translate to the strength or weakness of the US dollar.